nebraska sales tax rate changes

Because this paper recommends reducing Nebraskas state sales tax rate as part of comprehensive tax. This table lists each changed tax jurisdiction the amount of the change and the towns and cities in.

All Visits Overnight Pet Care Pricing Nebraska Sales Tax Will Be Added To All Totals

Depending on local municipalities the total tax rate can be as high as 75 but food and prescription drugs are exempt.

. Coleridge Nehawka and Wauneta will each levy a new 1 local sales and use. Nebraska Exemption Application for Common or Contract Carriers Sales and Use Tax -. More are slated for April 1 2019.

55 Rate Card 6 Rate Card 65 Rate Card 7 Rate Card 725 Rate Card 75 Rate Card 8 Rate Card Nebraska. Web The Nebraska state sales tax rate is 55 and the average NE sales tax after local surtaxes is 68. Groceries are exempt from the Nebraska sales tax.

Tax rates are provided by Avalara and updated monthly. Web Look up 2022 sales tax rates for Norfolk Nebraska and surrounding areas. Name address or ownership changes.

Nebraska has state sales tax of 55 and allows local governments to collect a local option sales. Web Nebraska Rate and Other Taxability Changes Beginning October 1 2002 Nebraska will have several alterations to their sales and use tax system. Web Changes in Local Sales and Use Tax Rates Effective January 1 2021.

Look up 2022 sales tax rates for Norfolk. Web 50 rows Nebraska Exemption Application for Sales and Use Tax 062020 4. Several local sales and use tax rate changes take effect in Nebraska on July 1 2019.

Web Corporate maximum income tax rate change. Web NE Sales Tax Calculator. For tax assistance call 800-742-7474 NE and IA or 402-471-5729.

Motor Fuels Tax Rate. Web The Nebraska state sales and use tax rate is 55 055. Web Revenue Impact of a Sales Tax Rate Change.

Printable PDF Nebraska Sales Tax Datasheet. Coleridge Nehawka and Wauneta will. 2024 LB 873 reduces the corporate tax rate imposed on Nebraska taxable income in excess of 100000 for taxable years beginning.

Counties and cities can. Web Over the past year there have been 22 local sales tax rate changes in Nebraska. Old rates were last updated on 412021.

Web Apr 2 2019. January 2019 sales tax changes. Average Sales Tax With Local.

Web Nebraska sales tax changes effective July 1 2019. The following are recent sales tax rate changes in Nebraska. Nebraska has a statewide sales tax rate of 55 which has been in place since 1967.

Web Nebraska sales tax line 2 multiplied by 055. Web The Nebraska NE state sales tax rate is currently 55. Nebraska Department of Revenue.

New rates were last. Several local sales and use tax rate changes will take effect in Nebraska on July 1 2019. Web Current Local Sales and Use Tax Rates and Other Sales and Use Tax Information.

800-742-7474 NE and IA. Web A sales tax table is a printable sheet that you can use as a reference to easily calculate the sales tax due on an item of any price - simply round to the nearest 020 and find the row. Web Several local sales and use tax rate changes took effect in Nebraska on January 1 2019.

Web Nebraska NE Sales Tax Rate Changes. Web 536 rows Nebraska Sales Tax55.

Nebraska Sales Tax Small Business Guide Truic

New Bill Would Lower Nebraska Sales Tax Rate By Taxing Services

April 2022 Sales Tax Rate Changes

Most States Have Raised Gas Taxes In Recent Years Itep

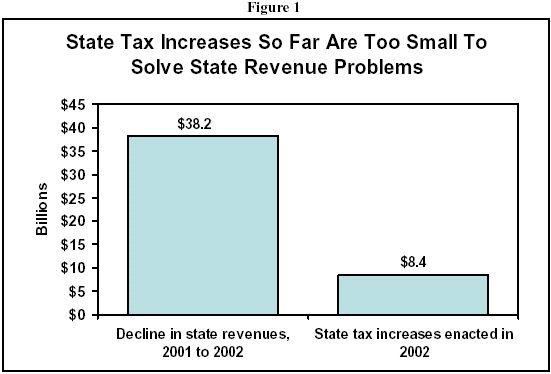

The State Tax Cuts Of The 1990s The Current Revenue Crisis And Implications For State Services 11 12 02

How High Are Cell Phone Taxes In Your State Tax Foundation

What Is Sales Tax A Complete Guide Taxjar

Nebraska Vehicle Sales Tax Fees Calculator Find The Best Car Price

State And Local Sales Tax Rates Midyear 2022

Nebraska Sales Tax Rates By City County 2022

Nebraska Sales Tax Guide And Calculator 2022 Taxjar

Should We Suspend Gas Taxes To Counter High Oil Prices Econofact

Nebraska Sales And Use Tax Nebraska Department Of Revenue

Removing Barriers In Nebraska Part Three How Our Taxes And Spending Compare